- #Spreadsheet for independent contractor expenses how to#

- #Spreadsheet for independent contractor expenses download#

Now that you’re self-employed, you have an additional, extra-valuable level of deductions: business deductions. (For more information, see the book on Amazon: Independent Contractor, Sole Proprietor, and LLC Taxes Explained in 100 Pages or Less.) The Importance of Business Expenses (Schedule C Deductions) The figure here is for 2021.) The 2.9% Medicare tax, however, does not have a limit. It’s important to note that the 12.4% Social Security tax only applies to the first $142,800 of earned income per year. (This odd multiplication figure is the result of the fact that you’re allowed to deduct 50% of your self-employment tax when calculating the income upon which the tax will be charged.) To calculate your net earnings from self-employment, subtract your business expenses from your business revenues, then multiply the difference by 92.35%.

#Spreadsheet for independent contractor expenses how to#

How to Calculate Your Self-Employment TaxĪs long as your “net earnings from self-employment” are $400 or more, you will be responsible for paying the self-employment tax - calculated as 15.3% of your net earnings from self-employment. We simply call the tax something different we call it the self-employment tax. You are therefore responsible for paying both halves of the Social Security and Medicare taxes, or 15.3% in total. Given that you are self-employed, there is no employer with whom you can split the burden. As a result, an amount equal to 12.4% (or 6.2% + 6.2%) is paid in total for Social Security tax, and an amount equal to 2.9% (or 1.45% + 1.45%) is paid in total for the Medicare tax. At the same time, the employer also pays both taxes, calculated at the same rate.

The employee’s share is calculated as 6.2% of the employee’s wages for Social Security tax and 1.45% for the Medicare tax. The way these taxes are structured, the burden is shared equally between the employee and the employer. A portion of the amount withheld from an employee’s wages goes to pay the Social Security and Medicare taxes. If you’ve had a job where you were paid a salary or an hourly wage, you’re probably familiar with the fact that part of your income was withheld for taxes. In reality, however, sole proprietors are simply paying this particular tax instead of another one. Why the Self-Employment Tax ExistsĪt first glance, it seems unfair that entrepreneurs - the most important driving force behind our economy - would be forced to pay an additional tax. The tax is calculated by multiplying your earnings from self-employment by approximately 15%. The self-employment tax is a tax that gets added to your normal income tax. Nys dcss.(The following is an excerpt from my book Independent Contractor, Sole Proprietor, and LLC Taxes Explained in 100 Pages or Less.)

Ser estar answers worksheet vs quia Irs 1099 Forms For Independent Contractors Form : Resume Examples 1099 forms form irs blank int independent contractors Independent Contractor Expenses Spreadsheet Spreadsheet Softwar Ĭontractor independent spreadsheet expenses Lists - Įxamples NYS DCSS | Income Withholding Worksheet withholding ny income worksheet parent order services nys childsupport gov total withhold cycle pay noncustodialġ099 forms form irs blank int independent contractors. Invoice spreadsheet Worksheet 2 Ser Vs Estar Answers | TUTORE.ORG - Master Of Documents

#Spreadsheet for independent contractor expenses download#

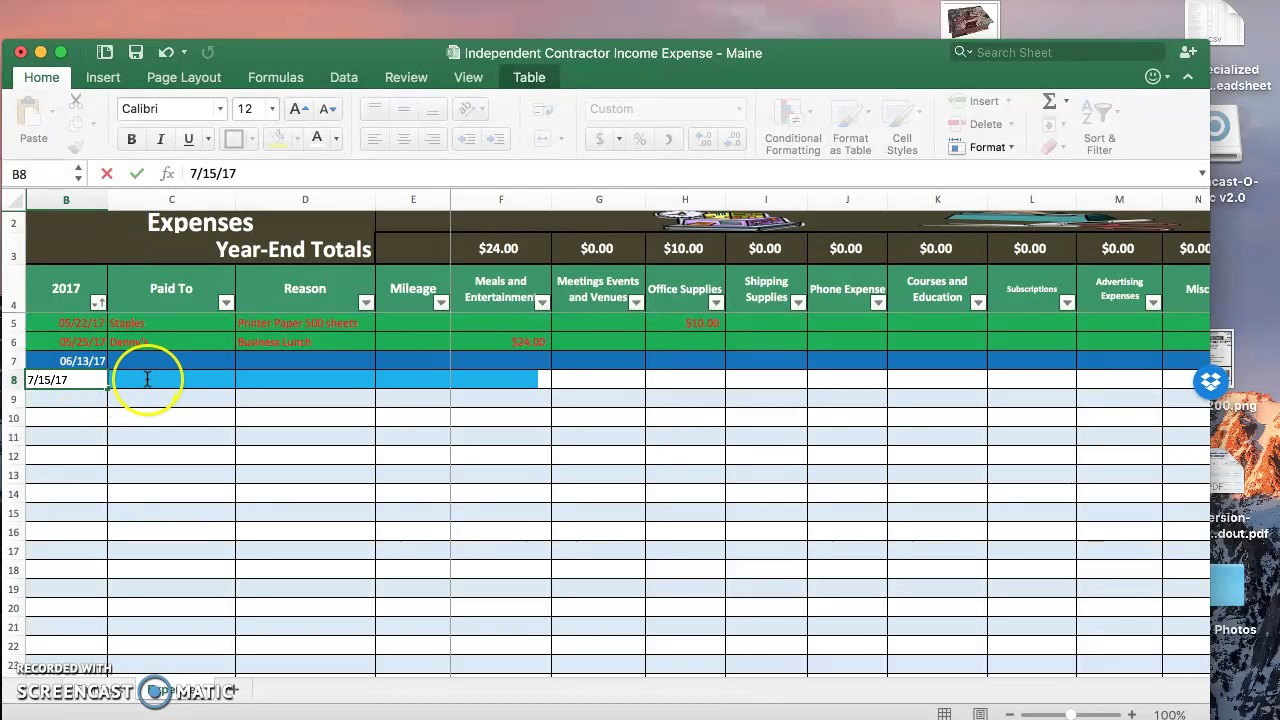

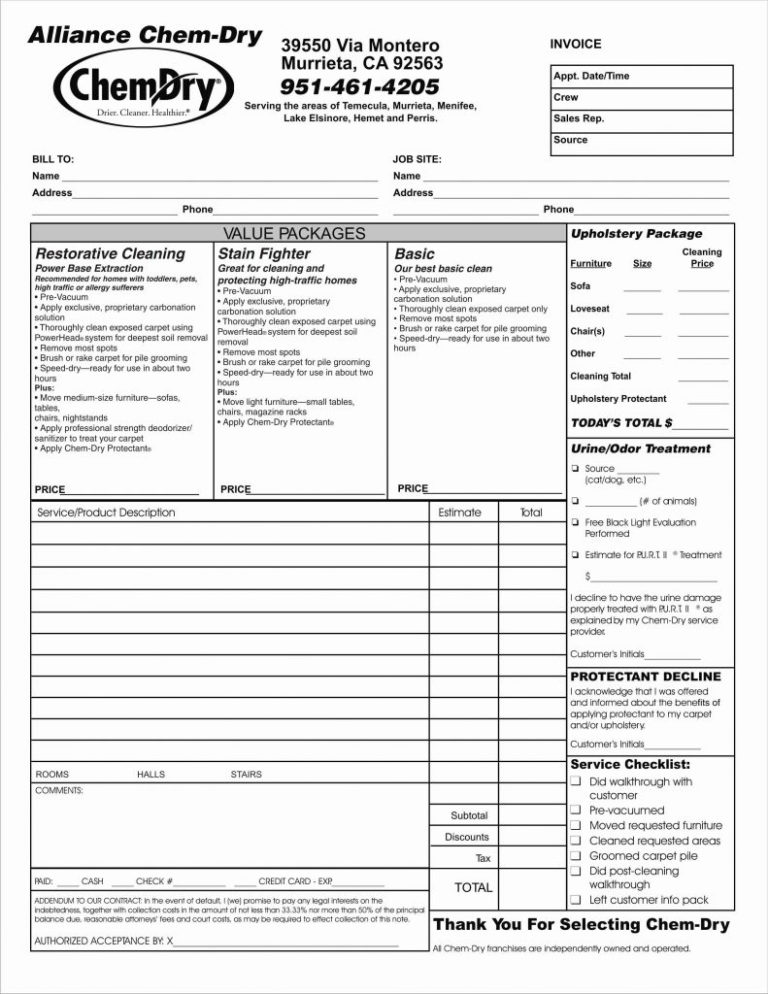

50+ Printable Timesheet Templates Free Word, Excel Documents timesheet Independent Contractor Invoice Template Free Download - Template invoice Free Printable Service Contract Forms | Free Printable Ĭontract forms printable service agreement contractor templates independent amp source Gst Spreadsheet Template Australia In Invoice Template For Contractor 9 Pictures about 50+ Printable Timesheet Templates Free Word, Excel Documents : Independent Contractor Expenses Spreadsheet Spreadsheet Softwar, Independent Contractor Invoice Template Free Download - Template and also Worksheet 2 Ser Vs Estar Answers | TUTORE.ORG - Master of Documents. 50+ Printable Timesheet Templates Free Word, Excel Documents.

0 kommentar(er)

0 kommentar(er)